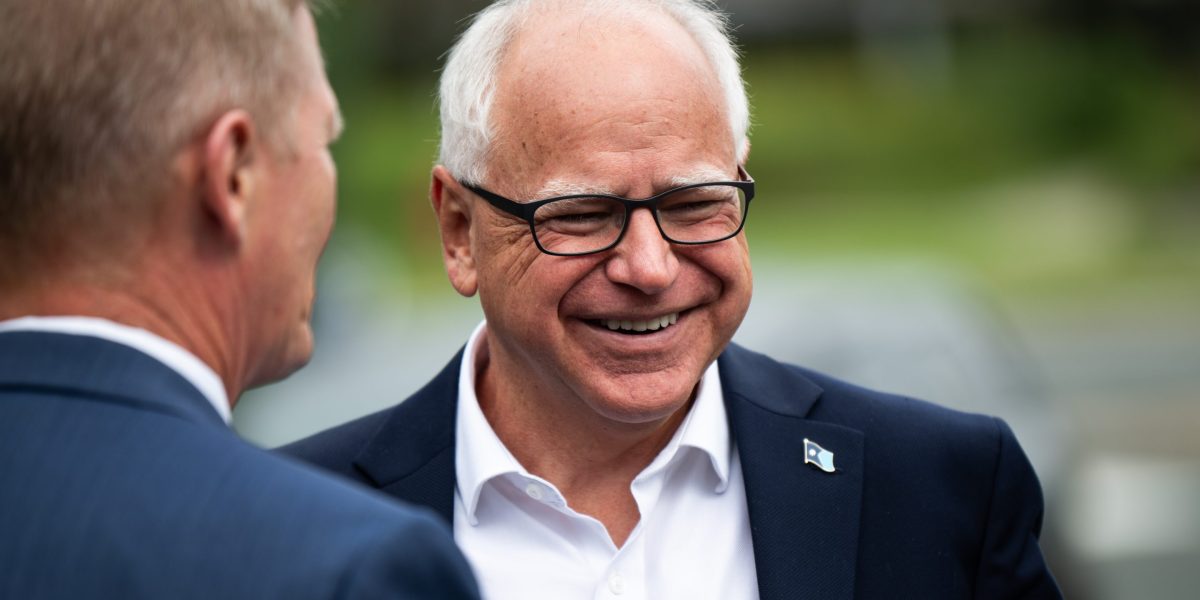

The all-American working man demeanor of Tim Walz—Kamala Harris’s new running mate—looks like it’s not just an act.

Financial disclosures show Tim Walz barely has any assets to his name. No stocks, bonds, or even property to call his own. Together with his wife, Gwen, his net worth is $330,000, according to a report by the Wall Street Journal citing financial disclosures from 2019, the year after he became Minnesota governor.

With that kind of meager nest egg, he would be more or less in line with the median figure for Americans his age (he’s 60), and even poorer than the average. One in 15 Americans is a millionaire, a recent UBS wealth report discovered.

Meanwhile, the gross annual income of Walz and his wife, Gwen, amounted to $166,719 before tax in 2022, according to their joint return filed that same year. Walz is even entitled to earn more than the $127,629 salary he receives as state governor, but he has elected not to receive the roughly $22,000 difference.

“Walz represents the stable middle class,” tax lawyer Megan Gorman, who authored a book on the personal finances of U.S. presidents, told the paper.

So now you’re back to saying that it is a legal definition. You’re confusing me more. You initially said pensions are legally defined as income. Then you said that legal wasn’t the right word and even edited that out of your comment. Now you’re back to saying there’s decades of laws. If you don’t know whether it’s legally defined as income then how am I supposed to know it?

Everything I’m finding online seems to indicate it can be viewed one way or another depending upon opinion and whether a lump sum option is available. You seem to be saying its always income? You haven’t clarified the lump sum option and how a pension with that option should be viewed from your opinion. And from an, albeit quick, look online I can’t find legal resources that indicate it is a hard rule. Even the link I provided and even the details you highlighted from that do not say its always a hard rule that all pensions are always income and never an asset.

I know one case doesn’t change decades of laws, but I can’t easily find these decades of laws and accounting rules. Most of what I’m finding when trying to look talks about the accounting for managing the pension itself and the assets of the pension which obviously doesn’t answer the question at hand.

So all of that said, do you have a resource you can point me to in order to help educate myself in the legal and accounting rules for how to treat pensions for individual finance and not something from the corporate finance side? Not that I don’t trust you, but we are both strangers on the internet after all.

deleted by creator

Yeah…that doesn’t answer my question. That only answers how the IRS treats income from the pension.

You can derive income from assets can you not? Am I misunderstanding assets? I would view rental property as an asset and you can get income from that. I would view a 401k as an asset and you can get income from that.

If I say I’m worth $500k more because of my pension. How does that have anything to do with the IRS?

deleted by creator

Maybe if I put this another way I can get some clarification on your position?

You have two people. Person A and Person B. Both have emergency funds in savings of $20,000. Person A has a 401k currently worth $500,000. Person B has a pension currently with a cash lump sum value of $500,000. Neither has any real estate, nor other investment accounts, but neither has any debt either. I would say they have the same net worth of $520,000. If I’m understanding you correctly, you would say Person A has a net worth of $520,000 but Person B has a net worth of $20,000. And it would be illegal and against accounting rules to include Person B’s pension in net worth calculations.

I’m seeing plenty of resources online that even go so far as to include instructions for finding a value of the pension for calculating net worth.

https://livewell.com/finance/how-to-calculate-value-of-pension-for-net-worth/

https://www.sapling.com/12011834/factor-pension-net-worth

https://networthcalculator.io/calculate-pension-in-net-worth/

https://www.lazymanandmoney.com/pension-net-worth/

And then this article finally showed up on my third page of results when searching for “do you include pension in net worth” and it at least mentions that it’s debatable whether to include it or not. And this article is for Canada. https://www.moneysense.ca/columns/ask-moneysense/should-you-include-your-pension-in-your-net-worth/

This is why I’m so confused. And you’ve been the most adament that it’s a big no-no. I’m not trying to argue with you. I’m seriously confused and trying to understand what I’m missing.