If Trump gets his way and removes Jerome Powell as chairman of the U.S. Federal Reserve, the market reaction would be swift and brutal, Deutsche Bank’s George Saravelos argues.

It could collapse the currency and bond markets, he says in a note seen by Fortune. Polymarket puts the chances of a Powell ouster at 19%.

“We consider the removal of Chair Powell as one of the largest underpriced event risks,” Saravelos says.

I mean shit, the entire global economy almost collapsed because a boat got turned sideways.

Whatever this would represent, catastrophic isn’t enough of a word for it.

which also led to one of the classics:

I Freed This Handsome Cargo Ship From The Suez Canal And Now He’s Stuck In My Butt

Chuck Tingle is a prince among men

“I’ve been so worried about losing my old life that I forgot about all the exciting new chapters that lay ahead. I could’ve never seen Ever coming, but now that he’s here, I’m thrilled by what else lies on the road ahead.”

Well then it was all worth it, wasn’t it?

he will say Powell is fired, buy lots of bonds and stocks, and then say just kidding, and sell again

and you, Duestche bank, helped him and the russians do it via laundering money for him.

Duestche bank

Deutsche Bank

Douche Bank

Well, the USD as far overrated, so any correction is a) needed and b) painful.

The only hope is that a breakdown of US economy will be remembered as made by Trump and the GOP.

USD is already down 15% to the Euro as of the start of the year.

I think that’s what people seem to miss, here. Not the risk of a stock market crash but of a massive inflationary surge as domestic dollars rapidly outstrip natural resources. We’re staring down the barrel of Stagflation.

USD is already down 15% to the Euro as of the start of the year.

If Trump takes over the FED, that 15% will look like a dream.

Trump selected Powell back in 2018.

I know. But now he needs lower interest rates or it will make him look bad because it will expose his economic failures, something he hates.

Been waiting on Trump’s temper to get the best of him. You know the people around him are manipulating him in every way possible to avoid firing Powell. This is a thing he can’t lie, cheat or walk back. Most of all, it would instantly devastate the rich. And then the rest of us of course.

Great article that hits hard on a subject I’ve been thinking on.

what is the upside for MAGA of devaluing USD?

They want to destroy America because corporate centrists already destroyed their rural communities.

Stock market numbers go higher

American manufactured products are cheaper on the world market.

Raw resources are more expensive to import so source everything form the US

making more money is good, but lowering the worth of your workers is another way to afford more people

deleted by creator

Easier to pay down debts made up of worthless money (if you have money that isn’t worthless). If you had €100 in November 2024, you could pay off $100 debt. Right now you only need €85 to pay off $100 debt.

I’d allow it so that people will finally realise.

People will cheer the low interest rate on their plummeting dollar value debt.

Realize what? They’ll say “fucking Biden, look at the state he left the country”

I live and work in a third world country. The currency here is weak against the dollar.

I do something think if the dollar crashed to the value it is in this country, I could pretty quickly pay off my families debts.

We already knew this, it’s just matter of time.

So…what do I buy puts on, to profit from this?

SPY or related index etfs

If you assume the entire stock market won’t collapse. Half those companies aren’t just inbred, they’re codependent.

Finally, some good news.

Yes

“you want to short the federal government??? yeah we will take your money high five bro”

I think I’ve seen this movie.

You can buy inverse ETFs on bond market benchmarks. Unlike stocks though, the interest rate will tick up as bond demand (price) goes down, so the dips tend get muted as people gobble up anything over 5%

deleted by creator

Do itttt

Well what’s another lifetime if I get to pay enough of the house that my grandchildren can probably rent it for a lower monthly installment?

How can it collapse the currency market? If one currency goes down in value the other goes up. Currency traders earn money either way they thrive on volatility.

He probably means the USD is going to drop and that will have severe consequences for the world economy. Since the US is a net importer. And most debt in the world is held in USD.

If Trump gets his way and removes Jerome Powell as chairman of the U.S. Federal Reserve, the market reaction would be swift and brutal, Deutsche Bank’s George Saravelos argues.

Okay, lets game this out. The Trump Admin is stacked with private equity bankers, silicon valley hucksters, and individually super-wealthy plutocrats.

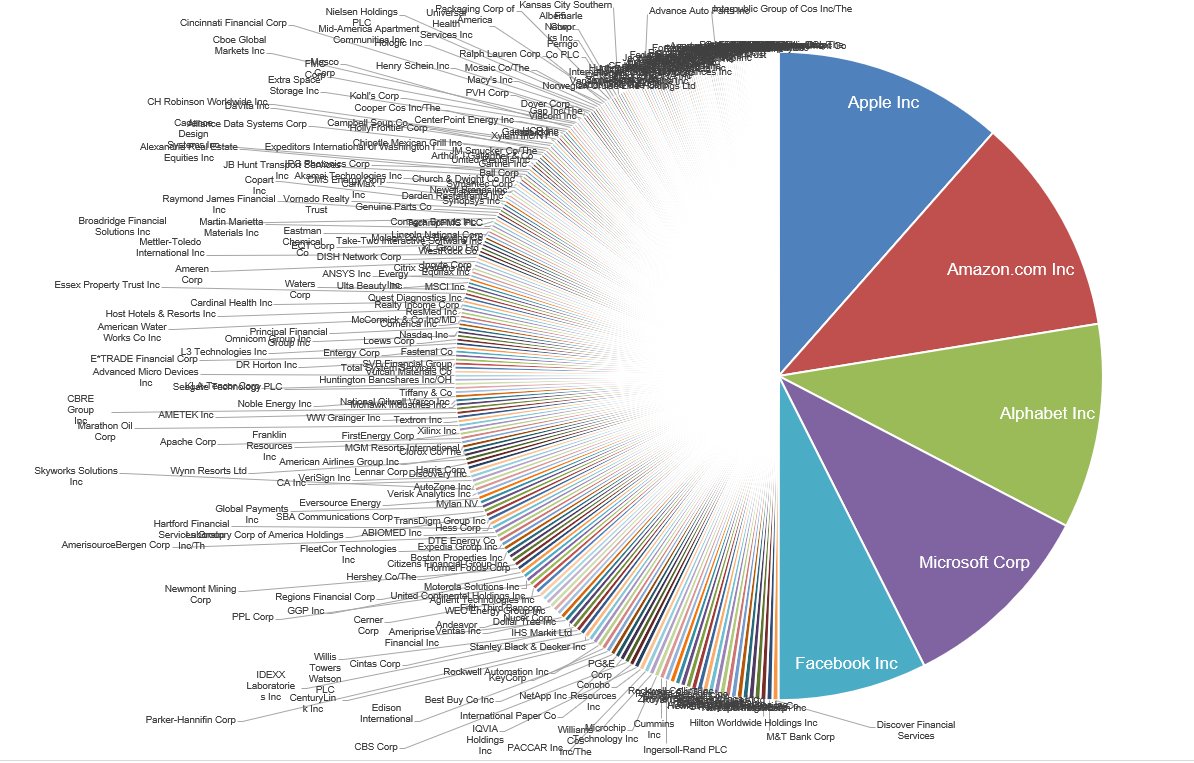

The estimated current valuation of the U.S. stock market is $46.2 trillion, according to Siblis Research. This value has tripled over the last 20 years. (In 2003, the total value was $14.2 trillion.) Based on this estimate, the richest 10 percent of U.S. households own roughly $42.7 trillion in stock market wealth, with the richest 1 percent owning $25 trillion. The bottom half of U.S. households own less than half a trillion dollars in stock market wealth.

So, we’re left asking the simple question. If the market has an enormous sell-off, who will be doing the selling?

BlackRock, Vanguard, State Street? That’s $21T of the $46.2T in equities right there. Which one of these titans blinks? How about Fidelity or JP Morgan Chase? Are they divesting to the tune of hundreds of billions of dollars if Jerome Powell is replaced?

And if they are divesting from the market, which equities are they selling?

The Mag7 make up over 50% of the valuation of the current S&P 500. If Jerome Powell is fired, which one of these stocks should I view as overvalued and look to sell off?

Because you can make a fuckton of money if you can answer this question correctly. Place your bets. Place your bets.

That said, I’ve heard a more compelling argument. The Mag7 is driving the current S&P 500 valuation. And the Mag7 is being propped up by speculative investment in new computer chips. Which means the real lynchpin in the economy is…

Back in May, Yahoo Finance’s Laura Bratton reported that Microsoft (18.9%), Amazon (7.5%), Meta (9.3%), Alphabet (5.6%), and Tesla (0.9%) alone make up 42.4% of NVIDIA’s revenue. The breakdown makes things worse. Meta spends 25% — and Microsoft an alarming 47% — of its capital expenditures on NVIDIA chips, and as Bratton notes, Microsoft also spends money renting servers from CoreWeave, which analyst Gil Luria of D.A.Davidson estimates accounted for $8 billion (more than 6%) of NVIDIA’s revenue in 2024. Luria also estimates that neocloud companies like CoreWeave and Crusoe — that exist only to prove AI compute services — account for as much as 10% of NVIDIA’s revenue.

These companies need lower borrowing costs in order to keep buying more chips. And Powell needs to go in order to lower interest rates, which will facilitate more borrowing and more chip-buying.

It is, in fact, Powell that is a mid-term threat to S&P 500 valuation thanks to his intractable stance on interest rates. And Trump’s efforts to remove him are driven by his own cabinet’s need to keep inflating the bubble that is the US Tech Sector.

Considering I’ve lost all faith in fiat currencies, including the US dollar, I no longer measure my net worth in it, this would be quite good for my gold and monero holdings. Because those are stable assets, not controlled by the whims of any central bank or government.

Unless there’s a bug in Monero that nobody has discovered yet, which would explain why it keeps losing value relative to bitcoin.

Bitcoin seems to change value more dramatically than Monero, from everything I’ve seen. That works both ways, though.

That is weird. It should have gone up a lot since 2018 because of the smaller market cap and excellent fundamentals.

I can’t even argue with you. It’s practically a stablecoin by crypto standards.

My understanding is that it was deliberately designed that way because it was intended to be used as a medium of exchange and not a vehicle for investment.

One of those fundamentals is a tightly scheduled supply. The tail emission is just to ensure mining security and is insignificant compared to XMR appreciation. That’s why the guy above saves gold and Monero.

Hell yeah. Also have a look at XMRBazaar.com where you can buy and sell legal goods and services directly for Monero. X premium, Spotify, Canva pro, laptops, houses, cars, etc. are all on there and many things are priced directly in Monero.

While that is a possibility, there are a lot of incredibly intelligent people who do their absolute best to make sure that that does not happen.

And just like Bitcoin, upgrades are only deployed after they have been thoroughly vetted and torture tested to hell.

I’d hesitate to use Monero as an investment, or for long-term storage.

Because of its nature, lots of powerful people (if they were aware of it) would be terrified of it and do everything they can to kill it, including legislation. I just don’t trust governments to not destroy it if it ever became popular enough.

It might be stable now, but all it takes is some purposefully stifling regulations from EU and US…

Which is why I hold it as a long-term store value. The harder they regulate it, the more the strizend effect happens.

I want them to be fucking terrified. I want them to wake up at night in cold sweats screaming their fucking heads off because that’s how afraid they are. I want them to have stress-induced heart attacks caused by Monero.

That would be success to me.

Yeah, I mean… Good luck with that I guess.

What really happens when they start arresting people when they find out they have Monero, is a chilling effect and a price crash.

Then they have to take all those people to court one by one, which wastes their own funds. And as they lose, because those are just regular people, then other people will start asking what the hell they’re doing.

Ok.