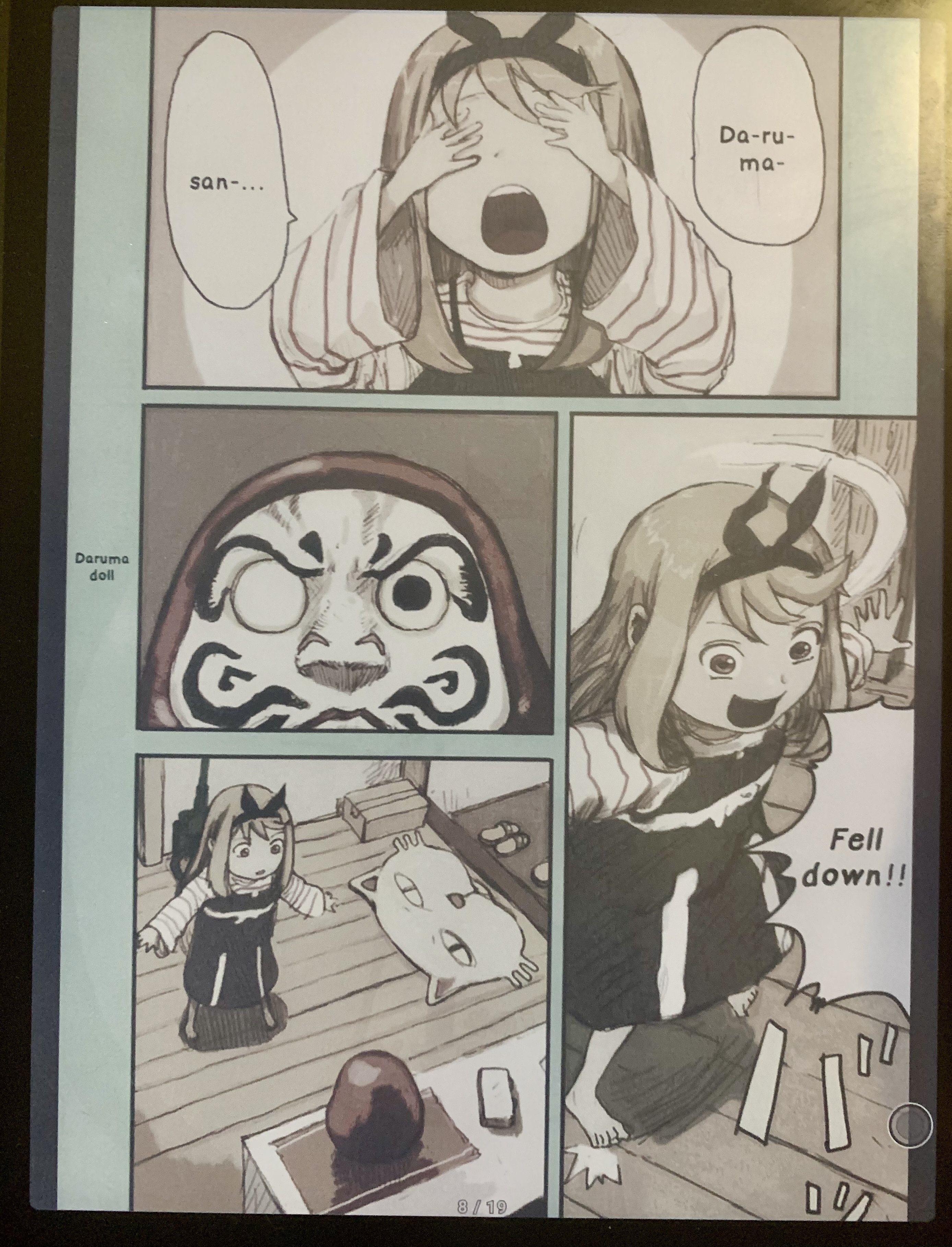

the picture was taken indoors under warm lighting. I do keep the front light at about 30% or ideally off because it strains my eyes when reading a lot (which I do, I use this thing several hours a day)

but I think that’s fair because I do the majority of my reading in this scenario, indoors under warm lighting, and I’d imagine many are in the same boat

I also have a 7 year old phone that I used to take the picture, and that part may be unfair. I’m actually getting a better phone soon and can maybe take a new shot

Software does make a difference though and perhaps go is doing more. With the boox you can use adb and surfaceflinger to increase the color saturation, but this doesn’t persist through reboots and is finicky to tune so I haven’t done it recently

Also fwiw as mentioned the replacement panel was not of the best quality. I mentioned the dead pixels but what I didn’t mention is when I got it the panel overall seemed warmer/redder in hue. This could all be in my head because I didn’t have it for 2 months while they were repairing it, but it could also be that some panels are better than others. They’re basically all kaleido3 panels, I think there are only 2 acep panel readers and one was that bigme kickstarter that they never actually sold, only ship to backers then basically abandoned. But maybe the limited production capabilities and somewhat high demand for panels means they’re rushing them out? I got the device on release so the initial panel was an early one and the replacement was about 2 years later. But again this could all be my in head

Oh i didn’t think you were saying anything, just providing additional context to anyone looking at the pictures

Fwiw I would definitely get a color ereader again. It’s not the most incredible color but I think it’s worthwhile to have especially for the price to get color vs non color. But if you’re only reading text with no images (like my mom only ever reads novels on her kindle) I think the non color is the better option bc the contrast is higher

It’s a shame this is such a niche market to eink and that they’re so focused on signage. I get that’s a much larger market but it still sucks. The newest panels like the spectra have pretty amazing color but the refresh time is even worse than the acep/gallery3 panels, which were outright rejected by boox despite having more vibrant color bc of the slow refresh rate. A spectra panels performance with kaleido3 or better refresh would change the game and imo make color e ink readers/tablets way more viable for more people