Which economy? The lived economy of the general public or the artificial economy of finance?

Wouldn’t both see a beneficial uptick from capital injection?

Capital isn’t injected, it’s hoarded.

The rich are already doing fine. They’re doing better than they have since 1920. As a class, they have so much money that they’re able to do stock buybacks because investing it doesn’t give moneygasm-style returns. We’re nearing the point where they can Scrooge McDuck-style swimming pools full of cash.

The problem with the current economy is very much not that the wealthy don’t have enough free capital. Quite the opposite, really.

The problem is that they have so much free capital because they’re addicted to non-productive methods growing their wealth.

I have no idea, but I’d like the powers that be to recognize that there are two economies and to prioritize the lived economy.

I first became aware of the difference when “the economy” was starting to boom in the 1980s even as we were busy returning to breadlines under the name of food banks.

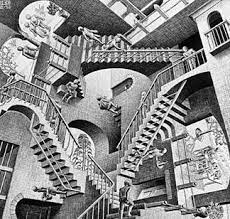

I’m not sure we even need the finance economy. A pure stock market is one thing, but by the time you get to rents over profit on actual production, the financialization of housing, derivatives of derivatives and all the other distancing from actual production, it’s just shell games with no benefit to society.

Precisely. What capitalism was supposed to do, it did long ago and now we’re mostly dealing with mentally insecure people at the top who think more about money than actual human relations.

Capitalism is supposed to ensure that the people that own the factories have all of the power. The current behaviour is core, fundamental capitalism.

It serves the ownership class. It always has. It’s its sole purpose. The rest of us have been supported by social programs that momentarily flared and, in the process, rescued the name of capitalism while workinf directly in opposition to it.

Sure, but which business injects capital in te first?

Your comment seems reasonable until you actually question the details:

How would forgoing a capital gains tax benefit the working public? Any answer you give will basically be “trickle down” economics, which has been proven to not work. Giant corporations and obscenely wealthy individuals hoard capital like a greedy dragon, they certainly don’t inject it!

EDIT: Of course they couldn’t answer that one simple question…

The wailing of hedge fund managers and the minions of the super rich is what lets us know the government is doing the right thing.

LOL at billionaires crying about being taxed.

More than just billionaires. Anyone who invests. But that’s disproportionately richer people, so it’s good. My complaint is that the tax isn’t raised enough.

No, it’s not “anyone who invests”. The change is only for capital gains above $250,000. If you’re reporting $250k or less in capital gains each year, you see no change whatsoever.

What retail investors are making those kinds of realized returns?

We can already see the opposition’s false equivalence rhetoric take hold. Here’s the difference:

Say you had 1M$ a couple years ago to invest (lucky you, was it a gift from your parents?). Say you didn’t do much research and invested in a stock that was pretty low at the time and you sell after the new tax at which point you see a return of an extra 25% (you were pretty lucky to beat the market with little effort). This means you get back 1.25M$ before taxes. The extra amount of money you have to pay with this new tax is exactly 0$ more than before! This is because your gains are 250k$ and you still haven’t reached the new limit.

If on the other hand you were even luckier and somehow managed to get 30% extra (!!!). You’re only going to pay the increased rate on 50k$ that’s above the 250k$ you made.

Now if you’re starting out with 10M$ and get the same kind of return that new tax is going to bite.

Ask yourself though, who is playing with that kind of money. It’s not the vast majority of “people who invest”. It’s going to be the extra rich.

Don’t forget you only get taxed extra if you realize all those earnings in the same year. So not only do you need to make more than 250k you also need to have a reason to take it out all at once rather than a little bit each year as you typically would if it were retirement income or something along those lines.

For the average person it would just effect them selling their house

It doesn’t apply to returns from selling your primary residence, even.

The only people outside of the ownership class (landlords, and people who own and peddle stock for a living) who are going to get caught in this are people who inherit an extra house.

I’m in favour of this new taxation structure, but there is a narrow group of people with modest means like my parents who will be disadvantaged by this new tax structure.

They live in the middle of buttfuck-nowhere with a large plot of cheap rural land. Principal residence only covers up to a half hectare of land, given you don’t meet certain niche exceptions. The actual house they live in is of little value; 100+ years old and probably to be demolished upon sale. The majority of the property value is in the surrounding land. Not a fortune or anything, but definitely more than $250k, which they’ll now need to pay at 2/3 capital gains (they bought it for next to nothing decades ago). Not gonna throw them into financial ruin or anything, but it will somewhat affect what they can afford to move into when they go to sell their place.

Again, I’m in favour of this tax structure, but just wanted to include this anecdote given the idea that this only affects billionaires.

The capital gains increase is progressive, and only applies to the portion of gains that exceeds $250k. So, yeah, they’re clearly an edge case, but they’re not paying the increase on the whole sale price or anything.

So they changed capital gains? Because before it subtracted through years lived in compared to value

Yes. Primary residences are exempt from the increase in the capital gains tax. People selling their primary residence are unaffected by the budget.

Not even house sales, really. None of us are lucky enough to gain a quarter of a million dollars through home ownership.

Unless by “us” you mean non-homeowners like me I strongly disagree. In my area (Vancouver Island) it would be extremely unlikely you wouldn’t see at least a $250k gain for anyone who purchased their single family home 10+ years ago, even 5 years ago for a lot of homes. I can’t say for sure, but I’d imagine the situation is quite similar for all but the most rural parts of BC.

No capital gains on principal residences, so the new rules would affect things like rental properties and secondary residences like a cabin.

I’m aware, I was replying to the notion that no one gains $250k by owning a home which is clearly false.

Rich people’s yacht money says what?

It’s an interesting thing that has happened to businesses lately, where making money isn’t good enough, they have to be making outrageous amounts or it’s not worth the effort. They’d rather close up shop than be forced to endure only modest profit

Such measures would deter investment at a time when we are striving to boost competitiveness and innovation within the industry and across the economy

competitiveness

Innovation like unnecessary return to office and less than inflation raises!

Don’t forgot about the pizza or one single box of slightly stale Tims donuts for an entire office. We’re a family here and our culture is important!!!

Innovation like a new coat of paint over chat-gpt and prompt “engineer”. Real value created here.

“Sure would be a shame if you taxed us and something happened to your economy…”

Ah, someone else who remembers the way the titans of industry and finance ratfucked the Rae government.

Oh, we need to boost competitiveness, do we?

How about we stop the rich from investing in non-productive asset classes like real estate, which seems to be the reason every economist says we’re stuck in a quagmire; because capital is being sucked up by real estate and financialization instead of investment into, well, anything else?

We could do that by…taxing the fuck out of capital gains?

No. Capital must go towards rent seeking. It’s only logical to invest in things that make money for free.

This is labour’s fault. If only we’d work harder and demand less pay (while not ever reducing spending), the economy would be great!

(/s, just in case)

How does principal residence work when you are moving and the related buying and selling?

No capital gains on principal residence. It would only come up on things like rental properties, cabins, or any other second property.

There’s also things like of a person has RRSP room and ends up in the edge case where this comes up just once or a few times in their life, they can use that to hold off the income tax until they can claim it at a lower tax bracket. If one isn’t put over by a single sale, (say selling multiple rental properties at retirement) they could spread those sales over multiple years to maximize that first $250k rate.

Do we even need these kind of posts in here…

What do you mean by “these kind of posts”?

[long awaited change that affects the richest 0.1%] ‘last thing the Canadian economy needs,’ say [representatives for the 0.1%]

This is the most important part to me. Aside from a handful of fringe cases, this targets exactly the group that many have asked to be taxed higher. Majority of people complaining seem to completely misunderstand how the tax system works and what exemptions apply. In most cases it seems like the changes don’t actually affect the things that people are worried about, or the actual difference is much lower. For example, many are worried about paying tax on the sale of their homes(primary residence exemption), their parents homes(only capital gains on period between transfer of ownership and sale, not all the way back to the parents’ original purchase price), they think the tax rate is 50/66%(that’s the amount of the gain that is considered income and taxes at the marginal rate) or they don’t understand that capital gains tax was already a thing and the actual difference is an additional 16% claimed for amounts over $250k, which means the actual difference in tax paid under the old and new systems is just a few percentage points unless the gains are significantly over $250k.

Funny how there is no alternative method of reducing or reversing the growing wealth disparity presented. The class of people who have done better than not only every other Canadian but virtually everyone else on Earth since the last world war that they ALSO profited from is telling us it is unfair to them while a growing number of people cannot eat and house themselves any longer. The very reason people cannot afford to survive is because the top is taking a larger portion of our productivity every single year.