“The Reserve Bank stuck to the script and left the official cash rate unchanged at 5.5 percent, confirming an end to its 21-month tightening campaign”…

“It said inflation, currently at an annual rate of 6.7 percent, was expected to keep falling as would inflation expectations, with a slowing global economy, an easing in supply chain disruptions, cooler labour and housing markets”…

“It estimated that inflation would be back in the target band in the second half of 2024”…

“We don’t expect OCR cuts until May next year, give or take”

As expected, but OCR at 5.5 for a while is going to hurt.

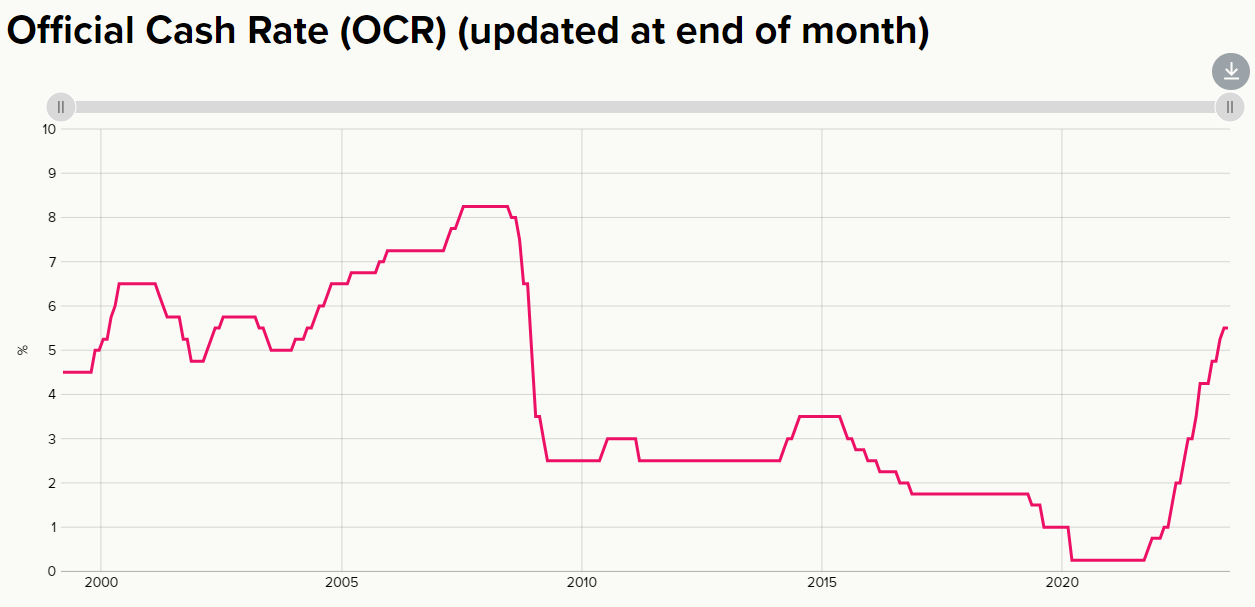

What’s the average OCR over the longer term?

Good Point - heres the Trend since 2000 https://www.rbnz.govt.nz/monetary-policy/monetary-policy-decisions

This just raises more questions!

People talk about the OCR like it’s how things work but your link says the OCR was only introduced in 1999. How did things work prior to that? Because I know that people who have bewn around longer than me think of 7% mortgage interest rates as being closer to normal than what we have had from say 10 years ago until recently.

Price controls, tax rates and national wage arbitration between businesses and unions were all inflation influencing levers govt used.

Fucked if I know for the bit between the late 80s and 1999 though cause all that other stuff was dumped throughout Rogernomics era labour and the 90s national govt.

Thanks for the explanation!

Looking at historical inflation, it seems there weren’t many good controls prior to the 90s. Inflation was all over the place.

I think there was some way RBNZ could influence interest rates prior to the OCR… perhaps it was more direct than it is now? I don’t know the details, but I’m pretty sure there was something (and can’t find any info about it).

Fun fact. Modern inflation rate targeting monetary policy was invented in NZ by Don Brash (and others). It has since become economic gospel for most western banking systems. https://www.nytimes.com/2014/12/21/upshot/of-kiwis-and-currencies-how-a-2-inflation-target-became-global-economic-gospel.html

That’s a really interesting read, thanks for sharing!

Yeah, seems we’re gonna be here for a while

This was the expected outcome, last time to said they had “done enough” WRT rate rises.

5.5% for a year will hurt just a little, but that should be eased a little by inflation pulling back. And way less than inflation continuing to escalate without income raised to keep up.

Edit: got to check the autocorrect more closely when posting from my phone.